Processing contributions

A contribution is when someone gives Free Geek money that is not associated with a gizmo donation. We want to track this type of income separately from donations where money may come in voluntarily when we receive gizmos from a donor, and from fees which are required (and typically accompany gizmo donations).

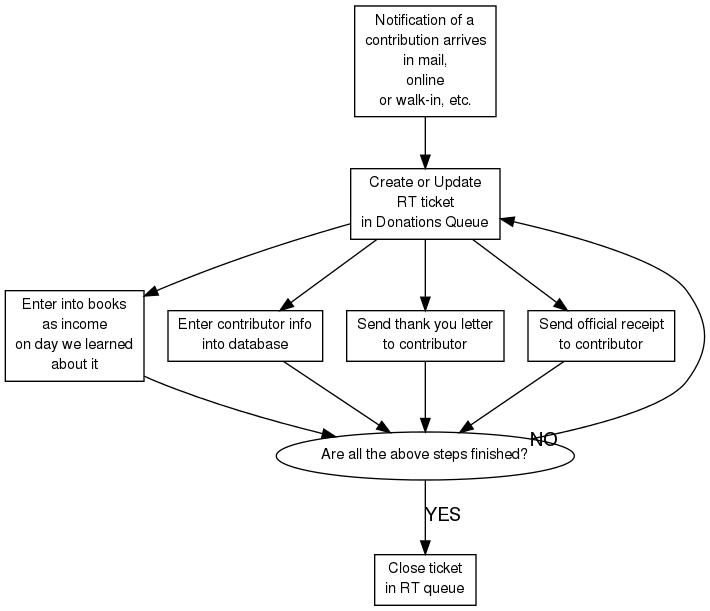

There are four things that need to be done to properly process a contribution:

Sometimes the money arrives on the same day that we learn about it, for example when someone mails us a check or manually gives us money in person.

Sometimes we received advance notification, for example when someone gives money online (in certain instances) but the money won't arrive until later on.

- PayPal contributions

- This happens when the contributor clicks on the "Donate" button on our web site. This generates an email with information that goes to the "donations" email list.

- Sometimes these "contributions" are actually payments for purchases, donations, and/or fees (or other types of income -- that is, not a true contribution). Check the notes field on such transactions to see if they should be treated as a contribution or something else. (In the case of a donation or fee, the database donation receipt should be marked as an invoice on the day it was created and this should be considered a payment on that invoice.) Who handled this?

- PayPal contributions should not be confused with PayPal payments for online sales. (We a separate PayPal account for that purpose.)

- Employee matching contributions

- This is when the contributor works for a company that has a contribution/donation program for their employees. Sometimes the employer matches the employees donation. We typically get these from individuals on a monthly, quarterly, or yearly basis. The date of notification in this case is when we receive written notice. (The actual money may come later on.)

- Facebook cause

- This comes when people donate through our facebook cause page (details needed here -- name of cause?). When we hear about these, we should use that date as the date of notification. The money arrives later on. There are more than one facebook causes that we have received contributions through. (At least two.)

- Authorize.net gateway

- We used this for the 30hour day auction. In this case the money arrives shortly after the contribution is made. We are considering setting up a contribute button on our web site that could be similar to our PayPal contribution (above). It would need to only accept contribution, however, and not accept any fees.

- Mailed in money

- This could come as a check in an envelope with a letter or return card. The notification date is the day we open the mail.

- Often times, money received this way is payment for an invoice (purchases, donations, and/or fees). It may take some investigative work to match up the random check with a proper transaction in the database, but it is important to take the effort to find out. Check the notes field on checks, the return address on the envelope, or any accompanying note to see if this should be treated as a contribution or something else. (In the case of a donation or fee, the database donation receipt should be marked as an invoice on the day it was created and this should be considered a payment on that invoice.) Who handled this?

- Money arriving in person

- This could come as a check, or credit card, or cash. The notification date is the day we receive the money.

- "In honor of", etc.

- Sometimes we receive contributions in any of the above ways from one person in honor of someone else. Sometimes this is in honor of a person who recently died, or sometimes it is in lieu of giving someone a birthday or Christmas gift. (Who gets thanked in such situation? The receipt goes to the person who actually gave the money.

Bookkeeping

Money should be counted as income on the date of notification (as opposed to the date of receipt in case they're different). In general the amount of the donation should be recorded along with the donors name as a separate transaction. In some cases (such as a large fundraising drive with lots of expected contributions) we may want to consolidate the information into daily, weekly, or monthly totals, rather than break them out into contributor specific transactions.

Database

The contributor's information should be recorded in the database, even if it's incomplete. Their "contributor" check box should be flagged.

Eventually, we will be able to enter contributions into the database to generate receipts. When that happens, we will also be entering contributions at this point, but for now it's just the contributor information.

Thank you letter

A proper thank you letter is necessary for maintaining good relations with contributors. It may accompany a receipt.

Receipt

A proper receipt is necessary for the contributor's records (and tax deductions). There is specific wording that needs to be on a proper receipt when the contribution amount is above a certain amount. (Something like "we affirm that no goods or services were provided in return for the donation amounts listed above.") The receipt may accompany the thank you letter.